Impact, Risk and Opportunity Management

Description of the Processes to Identify and Assess Material Impacts, Risks and Opportunities (IRO-1, G1 IRO-1)

As part of the double materiality assessment, Bittium identified impacts, risks and opportunities, taking into account the Group’s location, operations, sector and business structure. The assessment covers the Group’s entire business operations, but not the operations of associated companies. The list of sustainability aspects covered by the subject-specific ESRS standards presented in ESRS 1 was used to identify impacts, risks and opportunities.

Bittium carried out a double materiality assessment in accordance with the ESRS standards in 2024 together with Bittium’s management, the key personnel of the business segments and an external expert organization. External climate experts were utilized in the process of identifying transition risks and physical risks related to climate change.

In the double materiality assessment, Bittium’s material sustainability matters were identified and prioritized from two perspectives: Bittium’s impacts on people and the environment, and the financial risks and opportunities of the material sustainability matters in relation to Bittium. The risks and opportunities related to sustainability matters, and their likelihood, were taken into account in the assessment of the material impacts, risks and opportunities. The assessment of impacts also took into account different time horizons: short term (less than 1 year), medium term (1–5 years) and long term (more than 5 years).

In the double materiality assessment and the identification of Bittium’s material impacts, risks and opportunities, the company utilized EFRAG guidelines, ESRS 1 standard, internal data and reports, publicly available materials, stakeholder interviews with Bittium’s external stakeholders, the results of stakeholder surveys, and the results of meetings and workshops. The due diligence process was not taken into account at this stage of the assessment, as the extensive development of the process only began in the latter part of 2024. The material impacts, risks and opportunities were described, assigned scores and categorized into environmental, social and governance themes in accordance with the ESRS standards. In the process, impacts, risks and opportunities were identified throughout the entire value chain, including Bittium’s most important suppliers, partners, regulatory authorities, customers, shareholders and personnel. The views of the value chain participants were collected by means of external stakeholder interviews.

Views from the company’s own personnel and operational activities were from internal key individuals in meetings and workshops and by means of an electronic survey aimed at the personnel. Based on interviews with value chain stakeholders and a survey commissioned for personnel, assumptions were made about the views of value chain stakeholders and personnel, as well as the material impacts, risks and opportunities affecting them. The assessment of impacts, risks and opportunities included the identification of the stage of the value chain in which the impact, risk or opportunity occurs.

Bittium’s multidisciplinary working group assigned scores to the impacts, risks and opportunities in two workshops. The materiality of impacts was assessed on the basis of their severity and likelihood. Severity was based on the scale, scope and irremediable character of the impact. The scale, scope and likelihood of positive impacts was assessed. The impacts were also divided into actual and potential impacts. The assessment criteria were based on EFRAG guidelines.

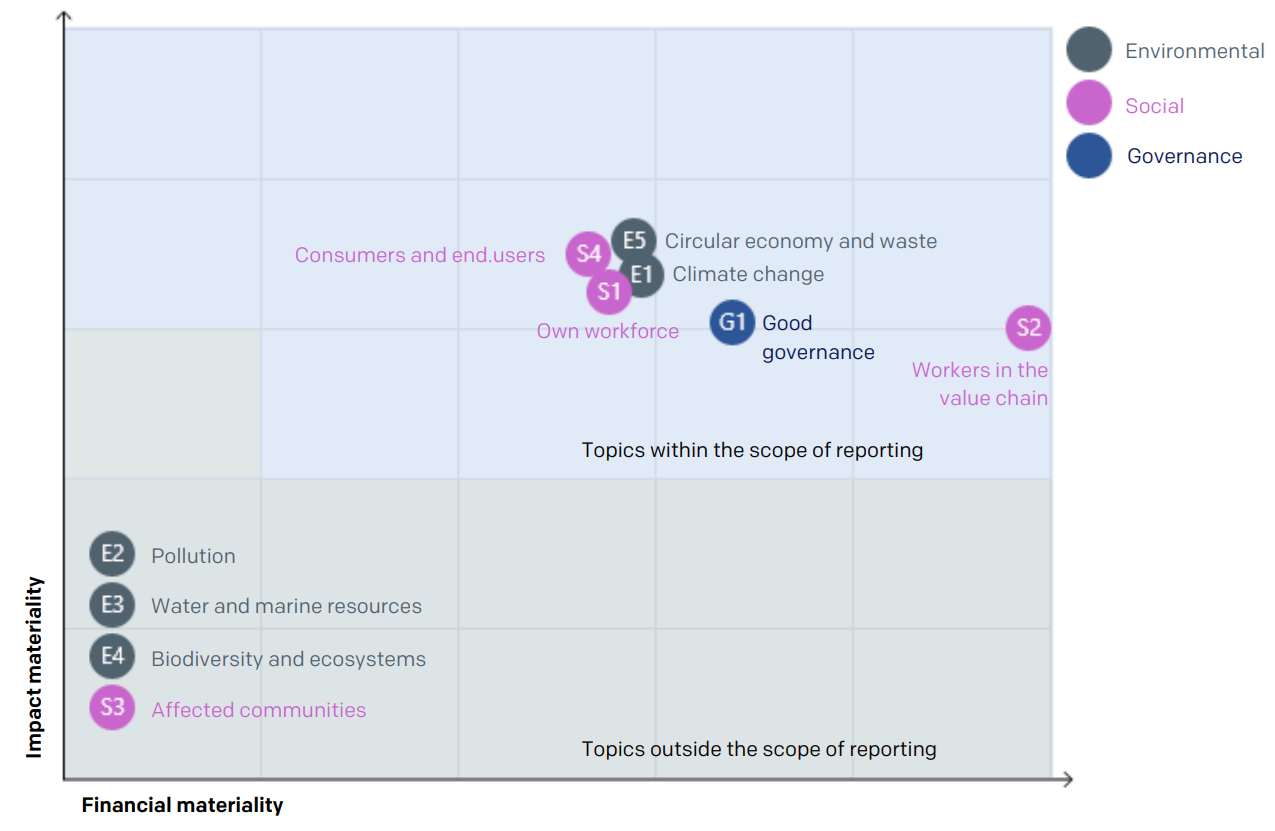

After the assessment rounds, the impacts, risks and opportunities were discussed and the results were visualized in matrices. (53 a,c) Materiality was assessed separately for impacts on people and the environment and financial effects. In both dimensions of the assessment, the highest values assigned for negative or positive impacts were taken into account in the assessment of materiality.

Factors that may increase the risk of adverse impacts were identified in the double materiality assessment process. These factors include low visibility into the procurement chain and human rights impacts, and potential conflict minerals, among other things. With regard to the material sustainability matters, the company assessed how the identified negative and positive impacts may affect the sustainability-related risks and opportunities. Material impacts and risks related to sustainability matters were identified on the basis of the assessment. Dependencies were typically assessed for different sustainability matters from different perspectives, i.e. there may be dependencies in terms of personnel, finances and nature, and they were taken into account in the risk assessment.

A sustainability matter was identified as financially material if it has, or could potentially have, a material financial effect on the company over some time horizon. The materiality of financial risks and opportunities was assessed according to their magnitude, type and likelihood. The likelihood of each identified impact, risk and opportunity, and the severity of the potential impact, was assessed on a scale of 1–5. The materiality of each impact, risk and opportunity was determined to be either low, moderate, high or critical according to the combined materiality score. Impacts, risks and opportunities with high (or critical) significance emerged as material topics. The results of the double materiality assessment process were validated together with Bittium’s key individuals and discussed by the Management Group, Audit Committee and Board of Directors. The results of the double materiality assessment were discussed and the assessment was further specified together with the company’s key individuals again in late 2024, and the final results were approved by the company’s Audit Committee and Board of Directors at the beginning of 2025. The threshold of financial materiality is described below.

Double Materiality Matrix

Bittium has a general risk management process into which the company has begun to incorporate the risks identified in the process of identifying, assessing and managing impacts and risks in accordance with sustainability reporting during 2024. The process will continue into 2025. Sustainability-related risks have thus far not been prioritized in relation to other risks. (53c iii.) Bittium’s materiality assessment was approved by the Board of Directors and its results have been approved by the Audit Committee and the Board of Directors. Bittium’s sustainability organization coordinates sustainability processes and their implementation in operations and processes. The process of identifying, assessing and managing opportunities has thus far not been integrated into Bittium’s management process, but it will be integrated by 2027.

Description of the Processes to Identify and Assess Material Climate-Related Impacts, Risks and Opportunities (E1 IRO-1)

Adverse environmental impacts are identified in connection with the annually reviewed double materiality assessment and on an ongoing basis in accordance with Bittium’s risk management process. This process of managing adverse impacts is implemented at the management, control, product business and project levels, and in the supplier interface. In 2024, Bittium carried out a broader assessment of climate-related risks and a scenario analysis to assess the physical climate risks and transition risks related to its own operations and value chain.

Bittium reports on impacts over three time horizons: short term (0–1 years), medium term (1–5 years) and long term (more than 5 years). An applied approach was used in the assessment of physical risks by combining the short term and the medium term (comparison periods 2020–2040 and 1990–2020). Long-term changes were examined in the scenario for the period 2040–2060. The choice of the time horizon is based on the lifetime of Bittium’s products, which is approximately 15 years at its longest. In terms of geography, the assessment was carried out in relation to the activities and the characteristics of the phenomenon causing the risk.

Bittium’s climate risks have been assessed by calculating the Group’s total carbon footprint in accordance with the GHG Protocol guidelines. The aim was to identify the most significant risks and climate-related impacts. Actual emissions have been calculated in accordance with the E1-6 disclosure requirements. Potential future GHG emissions have been estimated by taking into consideration the company’s targeted annual growth in net sales. (20a, AR9a, b) Bittium’s physical climate risks have been assessed in an RCP8.5 (Representative Concentration Pathway) compliant scenario that corresponds to global warming of four degrees. In this scenario, climate change is the strongest, which means it has the largest impact on Bittium’s product design, covering the potential risks the best among the scenarios. The scenario was examined using the EU’s Copernicus information service and the information service of the Intergovernmental Panel on Climate Change (IPCC) under the United Nations. Other applicable sources were also used in the analysis, including materials from NGFS (Network for Greening the Financial System), which is a global network of central banks and supervisors. Risk sensitivity and adaptability at the present time was assessed using Bittium’s risk impact framework. Exposure was estimated on the basis of climate data by assessing the frequency and intensity of incidents and the magnitude of change as the climate warms.

Bittium’s transition risks were assessed according to the time horizons specified above and for the long term, extending to 2060, in accordance with the scenarios. Regional differences were taken into account in the assessment at the continental level. Transition events were assessed in the Paris Agreement scenario (global warming of less than 2°C). In the scenario, transition risks consist of business activities that are not yet compatible with the transition to a climate-neutral economy. For Bittium’s product development, the transition to climate-neutral production causes the greatest change and thus provides the broadest coverage of potential risks compared to other scenarios. Bittium’s assessment of transition risks was based on the results of the latest scenario analyses created by institutions, such as the global network of central banks and supervisors. The results were categorized into transition risks and opportunities. Exposure assessment was carried out as a qualitative description, taking into account the duration of the transition event and the impact of the event on Bittium’s operations. Highly unlikely events were excluded from the scenario analysis.

The transitional provision is applied in the assessment of the anticipated financial effects, and the financial effects will be reported for the first time in the second year of reporting. For the time being, the financial materiality of the risks was defined so that only a phenomenon or event that affects product design or has previously caused significant financial effects is considered to be material. A scenario analysis was carried out for the material risks, based on which the likelihood of the events causing risks and opportunities during the specified time horizons was determined. Events assessed to be highly unlikely were excluded. The assignment of scores to physical risks took into account the frequency of the phenomenon in the region in question. The impact was defined as the vulnerability of the activity to the phenomenon in question, and the likelihood corresponds to exposure to a given natural phenomenon. In the first year of reporting, the material physical risks were assigned scores solely on the basis of technical performance. Financial effects will be taken into consideration in subsequent assessments. Qualitative descriptions were also provided for the impacts of physical risks, including information on how the event could affect cash flow.

Determining the exact likelihood was impossible for transition risks and opportunities. All of the identified transition risks, excluding highly unlikely risks and opportunities, were considered to be material. In the first year of reporting, material transition risks were assessed only in terms of a qualitative description, including the effects on cash flow. The descriptions also took into account Bittium’s dependencies on resources, such as natural resources and labor. The likelihood of the events for Bittium and the magnitude of the financial effects will be assessed in more detail in 2025–2026. The severity of material risks, i.e. the risk level, was determined by assigning scores according to the scoring methodology applied in Bittium’s double materiality assessment, in which the impact and likelihood were assessed on a scale of 1–5 and multiplied with each other.

On the Assessment of Topics Deemed Non-Material

The following topics were assessed as not material for Bittium: ESRS E2 Pollution, ESRS E3 Water and marine resources, ESRS E4 Biodiversity and ecosystems, and ESRS S3 Affected communities.

As part of the double materiality assessment, Bittium identified impacts, risks and opportunities, taking into account the Group’s location, operations, sector and business structure. (E3 8a) Bittium operates globally. In Bittium’s operations, components are sourced from suppliers and no significant amounts of water are used in Bittium’s own production activities. Consequently, the company’s own operations are not linked to significant water withdrawals or the deterioration of habitats through agriculture, forestry or construction. The partner used in connection with the materiality assessment organized two workshops in which Bittium’s impacts on nature and society, and the risks and opportunities arising from these impacts, as well as risks and opportunities arising from nature and society, were identified and assessed (double materiality). Stakeholder interviews were also conducted. Based on these, a double materiality assessment was prepared, in which Bittium’s key sustainability themes were identified. No specific stakeholder consultations have been organized for affected communities. During Bittium’s reporting and assurance process, the E2 topical standard was identified as non-material due to the low amount of substances of concern.

Bittium’s sites are located in Finland, mainly in urban areas, which are not classified as sensitive areas or protected areas for biodiversity, because the areas are areas zoned for office and commercial use and production facilities. During the planning phase, efforts are made to assess the natural values of the areas, and Bittium bases its scenarios on these studies commissioned by the planning authority. Bittium does not engage in activities related to construction, property development or agriculture and forestry. Impacts on water and marine resources and the deterioration of natural habitats and the habitats of species are possible in the upstream value chain, but Bittium is not aware of any significant environmental impacts related to the supply chain. The aforementioned impacts were assessed as minor in the materiality assessment, and it has not been considered necessary to implement any corrective biodiversity mitigation measures.

Description of the Processes to Identify and Assess Material Resource Use and Circular Economy-Related Impacts, Risks and Opportunities (E5 IRO-1)

Value chain participants’ views concerning resource use and the circular economy were collected by means of external stakeholder interviews, the participants of which included Bittium’s suppliers, customers, partners, the occupational healthcare service provider and a shareholder. Views from the company’s own personnel and operational activities were collected by engaging the participation of internal key individuals in workshops and by organizing a sustainability survey aimed at the personnel. Impacts on resource inflows and outflows as well as waste were identified throughout the value chain, including Bittium’s most significant suppliers, most important partners, customers, shareholders and personnel. During the mapping of impacts, risks and opportunities, a business model was developed by examining assumptions about where in the value chain actual and potential impacts, risks or opportunities occur.

Regarding the E5 circular economy theme, the mapping of impacts, risks and opportunities has specifically taken into account the impacts of the manufacturing, processing and transportation of the components and raw materials contained in Bittium’s products from the supply chain. Regarding the impacts, risks and opportunities of the company’s own operations and the end of the value chain, the sustainability, recyclability and end use of Bittium’s products have been taken into account. The amount of waste generated by the company’s own operations was measured as a special method. Regarding the company’s own operations and the end of the value chain, the mapping has assumed that the products are used and disposed of in accordance with the instructions provided by Bittium.

Disclosure Requirements in ESRS Covered by the Undertaking’s Sustainability Statement (IRO-2)

A list of the reported disclosure requirements is provided at the beginning of this sustainability statement, and a list of data points based on other EU legislation is provided at the end of this sustainability statement.

The double materiality analysis identified and prioritized the sustainability issues that are material to Bittium from two perspectives: Bittium’s impacts on people and the environment, and the financial risks and opportunities of the sustainability issues in relation to Bittium. The assessment of material impacts, risks and opportunities took into account the risks and opportunities related to the sustainability issues and their probabilities. The probability of each identified impact, risk and opportunity and the severity of the potential impact have been assessed on a scale of 1–5. For each impact, risk and opportunity, an aggregate value has been obtained on the materiality significance scale of low, moderate, high and critical. The materiality threshold was high (and critical).

More information on the materiality assessment is provided under disclosure requirement IRO-1 Description of the processes to identify and assess material impacts, risks and opportunities.