Material Impacts, Risks and Opportunities

E1. Climate Change

| Sub-topic | Description (occurrence in the value chain) | Negative/ Positive/ Risk/ Opportunity | Stage of the value chain affected | Time horizon |

|---|---|---|---|---|

| Climate change adaptation | Potential supply chain disruption due to extreme weather phenomena, which may affect component availability and thus lead to operational costs. | Actual financial risk | Upstream Own operations Downstream | All |

| Climate change can cause costs and changes in the durability of devices and products under special circumstances, as well as increase energy consumption associated with the cooling of data centers. | Potential financial risk | Own operations Downstream | Medium- to long-term | |

| The growing demand for products and solutions that support the green transition and are energy efficient will contribute to the reduction of the in-use emissions of products and the reduction of customers’ emissions. | Actual opportunity | Downstream | All | |

| Climate change mitigation | Growing regulation increases the need to allocate resources to monitoring, interpretation, the implementation of changes, and reporting. | Actual financial risk | Upstream Own operations Downstream | Short- to medium-term |

| Energy | Transitioning the company’s own business premises to renewable energy and improving energy efficiency through ecological product design, which reduces the in-use emissions of products. | Actual positive impact | Own operations Downstream | All |

Transition Plan for Climate Change Mitigation (E1-1)

Bittium updated its business strategy in 2023 and 2024. In 2024, Bittium also revised its sustainability strategy, basing it on the updated business strategy. In 2024, Bittium calculated the company’s carbon footprint for the first time, covering all emissions under Scopes 1–3. The calculation identified Bittium’s significant emission sources and yielded the values for the base year 2023, on the basis of which Bittium will specify its emission reduction measures. During the reporting year, Bittium began to develop a transition plan for the period 2025–2030. Operating expenditures related to the transition plan are described in section E1-3. Bittium aims to increase the share of sustainable business practices. As the scope of reporting practices expands and the practices become clearer, we expect the share of Taxonomy-eligible and Taxonomy-aligned activities to increase in the future.

The targets of Bittium’s previous sustainability strategy were set for the period 2022–2025. The sustainability strategy emphasized environmental responsibility, such as climate change mitigation and the development of resource-efficient solutions. The strategy took into account alignment with the UN Sustainable Development Goals.

In 2024, the company defined targets and measures for emission reductions in its own operations. Bittium’s target is net zero for Scope 1 and Scope 2 emissions by 2030. Bittium’s leased vehicles are the largest source of Scope 1 emissions. Bittium will transition to fully electric vehicles by 2030. With regard to Scope 2 emissions, the target is for 100% of the energy purchased by Bittium to be renewable energy by 2030. Bittium defined Scope 3 categories, of which the largest sources of emissions are purchased products and services, transportation, upstream leased assets, and use of sold products. In 2024, the company defined the total emission reduction need for Scope 3 emissions, which will be incorporated into the transition plan. More information on emission reduction targets is provided in section E1-4.

Reducing emissions requires improving the energy and material efficiency of products, engaging suppliers’ commitment to renewable energy, optimizing transport routes and transitioning to low-emission modes of transport. Bittium will define more detailed actions and time horizons for the defined Scope 3 categories in 2025. The baseline value calculated in 2024 was used to identify the largest sources of emissions and to determine the amount of emission reductions needed, which are in line with the Paris Agreement goal of limiting global warming to 1.5°C. The GHG emission reduction targets included in Bittium’s transition plan comply with the minimum requirements set by the Science Based Targets initiative (SBTi). The targets have not been validated by the SBTi. Bittium did not identify any locked-in emissions in its operations.

In its sustainability strategy, Bittium has made a commitment to combating climate change by focusing on renewable energy in its energy procurement, reducing business travel and improving the recycling of waste from its own operations. The company monitors three key environmental impact indicators in its operations: GHG emissions (CO2eq) and the development of energy consumption (MWh), as well as the percentage of renewable energy of total energy consumption. In previous years, environmental responsibility metrics also included travel (flying and road transport) and the electricity consumption, heating and waste management of business premises. New policies and targets for 2025–2028 have been established in the updated sustainability strategy. With regard to climate change mitigation, the strategy sets targets for the adaptation of the entire business to lower emissions and the development of more energy-efficient products. The targets of the transition plan and the sustainability strategy are in alignment. The sustainability strategy will be updated as necessary once Bittium’s transition plan has been specified further.

The targets of the transition plan are set for the medium term as defined by the ESRS standards (1–5 years). This means that the set targets will be achieved in 2030. The target is to start more detailed planning in 2025 to achieve emission reductions for products. The long lifetimes of the company’s products and long product development times have been identified as risk factors, as they may delay the realization of the desired impacts in the product groups and products sold. The raw materials of the components, their availability and possibilities of influencing the selection of suppliers have also been identified as a risk factor in achieving emission reductions.

Bittium is not excluded from the EU Paris-aligned Benchmarks in accordance with the exclusion criteria stated in Commission Delegated Regulation (EU) 2020/1818. During 2024, Bittium did not yet produce quantitative estimates of the company’s investments and financing to support the implementation of the transition plan. Bittium’s Board of Directors approved the sustainability strategy on November 28, 2024, and the transition plan on December 20, 2024. Investments and financing will be determined in 2025.

Material Impacts, Risks and Opportunities and Their Interaction with Strategy and Business Model (ESRS 2 SBM-3)

Implementation of the Resilience Analysis

The resilience analysis is based on the material impacts, risks and opportunities related to climate change mitigation and adaptation, as well as energy, identified in Bittium’s materiality assessment. During the process, it was observed that the list of impacts, risks and opportunities did not provide a sufficiently comprehensive picture of the climate risks related to Bittium’s own operations and value chain. For this reason, Bittium carried out a climate risk assessment and scenario analysis in the fall of 2024, the scopes of which are consistent with each other. The relationships between the material impacts, risks and opportunities and the physical risks and transition risks identified in the climate risk assessment are examined in the table on the following page.

The resilience analysis was carried out in the fall of 2024. The time horizons (short-, medium- and long-term) are consistent with the ESRS 1 recommendations. The GHG emission reduction targets are in line with E1-4 and set to be implemented by 2030. With regard to information on disclosure requirement E1-9, Bittium applies the ESRS 1 Appendix C transitional provision concerning the information on the year 2024. Consequently, that information has not been taken into account.

The materiality of all potential risks was assessed. The scope of the analysis covers all of Bittium’s own operations. This includes all sites and geographical regions with the exception of secret location data. The upstream analysis of physical risks extends to component suppliers and subcomponent manufacturers. For transition risks, raw materials have been taken into consideration in the analysis. The region of use of the products has been assessed in accordance with the targeted markets. The impacts of heatwaves on product design have been assessed for locations in accordance with the Military Standard (MIL) for the defense industry, and the impacts of heavy precipitation and storms have been assessed for seas and coastal areas relevant to Bittium’s operations. The critical assumptions made on the basis of the scenario analysis with regard to the transition to a lower-carbon and more sustainable economy include potential increases in raw material prices, particularly for metals that play an integral part in the green transition, and potential future challenges in supplier selection. Rising logistics costs due to the elimination or reduction of emission reduction rights, particularly for air freight, was also identified as a market-related transition risk. Increases in the prices of fossil and green energy are also seen as a risk.

Results of the Resilience Analysis

In the low-warming scenario, Bittium’s business strategy is adaptable, as the aspects that are most critical to Bittium’s resilience in the short term are related to changing regulation and transition risks in supplier relationships. The impacts on product design, such as product durability and changes in physical conditions, are more moderate. Bittium’s resilience with respect to transition risks has already been strengthened through measures to improve the transparency of the supply chain, developing the material and energy efficiency of products, and operating in accordance with the ISO 50001 and ISO 14001 requirements.

Physical changes related to climate change may cause disruptions to Bittium’s component supply chain, particularly in the higher warming scenarios and in the medium and long term. Bittium’s resilience is fairly good in this regard, as the company has identified supply chain disruption risks and begun to mitigate them. Bittium strengthens its resilience by diversifying component deliveries, among other things. These measures are likely to limit interruptions and financial effects on business operations.

In the medium and long term, and in scenarios of higher warming, physical climate-related risks are emphasized, particularly with regard to product design. Bittium’s resilience is good in this respect, as the current products are designed in a manner that takes their long lifetime into account, and the selection of components takes into consideration the impacts of increasing heat, humidity or changes in wind conditions.

Bittium’s resilience is at its weakest in terms of fluctuations in the prices of raw materials, rising logistics costs, changes in emission reduction rights and increases in the prices of fossil and green energy. Rising costs can have significant impacts on business. These unpredictable transition risks, which arise in all of the assessed time horizons and are emphasized in scenarios of higher warming, will be assessed at regular intervals and taken into account in Bittium’s strategy work.

Changing market conditions, regulation and the impacts of various crises on suppliers require high resilience from supply chains. Bittium aims to protect its supply chains by ensuring, for example, the coverage of force majeure clauses in contracts and product development by selecting components and semiconductors in such a way that alternative suppliers can also be found for them. Supply chain management is implemented with the help of regular contract reviews. Market-related transition risks arise from the impacts of the green transition and rising logistics and raw material costs, such as the price development of air freight and availability challenges associated with certain critical raw materials. Bittium will improve its resilience by building a control mechanism for the increase in raw material costs, carrying out competitive bidding processes for component suppliers in a manner that takes logistics costs into account, and by utilizing transports with carbon credits. Continuous improvement in building more ecologically sustainable business, the production of environmental information concerning Bittium’s own operations and value chain, and transparency in reporting also support Bittium’s ability to access financing on competitive terms from the market in the future.

Resilience with regard to responding to regulations, reporting obligations and customers’ sustainability requirements can be strengthened by securing sufficient human and software resources, as well as competence related to the implementation of sustainability efforts and compliance with reporting requirements. Bittium processes customer feedback carefully and aims to communicate compliance-related perspectives, which mitigates transition risks related to stakeholder concerns and customer purchasing behavior. With regard to product development, Bittium ensures that sustainability actions do not have a detrimental effect on the performance and quality of products. If any harmful, prohibited or non-environmentally friendly substances or materials are observed, the alternatives for addressing such issues include changes in suppliers or product changes to ensure product safety, for example. Bittium aims to respond to supply chain transparency by investing in a supplier management tool and by increasing requirements concerning the provision of information for component suppliers during the contract negotiation stage. Changes in suppliers are also possible if suppliers fail to report the required information or prioritize green energy, for instance. There are challenges in this respect due to the special requirements associated with the production of defense and information security products, which limit the number of potential suppliers. In product development activities, low-emission solutions are actively sought.

The physical climate risks that are material to Bittium (particularly with regard to the impacts on the value chain) are shown in the table below. Product development and supply chain management also play a key role in resilience related to physical climate risks. With regard to climate risks, it is essential to select components in such a manner that there are multiple component suppliers, which reduces the impact of sudden climate events on supply chains. The impacts of increasing humidity and changes in wind conditions should also be taken into account in product design. Physical climate-related risks may have an impact on properties owned or leased by Bittium, as well as Bittium’s personnel.

The scenario analysis involves uncertainties. The mitigation of emissions in accordance with the Paris Agreement may take place in many different ways in practice, but the common denominator is electrification and the related critical raw materials. Another fairly certain change is increasing regulation. Events related to stakeholder behavior are the most uncertain aspects of the analysis. The uncertainty of all transition events increases significantly in the long term when compared to the short and medium term. The scenarios are descriptive and it is not possible to establish exact timelines for events.

If the risks were to materialize, it could be necessary to move infrastructure away from at-risk areas or increase the cooling of the premises to mitigate the impacts of heatwaves. Bittium’s resilience is strengthened by Bittium’s environmental and quality systems, as well as sustainable development projects and networking with other companies (the environment and performance working group of Finnish Defence and Aerospace Industries PIA and the environmental working group of Kotel ry).

| Active impact / risk | Physical / transition risk | Category | Climate risk | Opportunity / positive impact |

|---|---|---|---|---|

| Growing regulation increases the need to allocate resources to monitoring, interpretation, the implementation of changes, and reporting. (upstream, own operations, downstream, risk) | Transition risk | Policies and legislation | Increase in GHG emission prices | Transitioning the company’s own business premises to renewable energy and improving energy efficiency through ecological product design, which reduces the in-use emissions of products. (own operations, downstream, positive impact) |

| Technology | Replacing products and services with lower-emission alternatives | |||

| Costs incurred from switching to lower-emission technology | ||||

| Transition risk | Policies and legislation | More comprehensive emissions reporting obligations | The growing demand for products and solutions that support the green transition and are energy efficient will contribute to the reduction of the in-use emissions of products and the reduction of customers’ emissions. (downstream, opportunity) | |

| Assignments and regulation concerning existing products and services or production processes | ||||

| Reputation | Negative feedback from stakeholders | |||

| Growing concern among stakeholders | ||||

| Market / reputation | Changes in customer behavior | |||

| Climate change can cause changes in, for example, the durability of devices and products under special circumstances (downstream, negative impact) | Transition risk | Technology | Failed investments in new technology | |

| Market | Uncertainty of market signals | |||

| Potential supply chain disruption due to extreme weather phenomena, which may affect component availability, for example, and thus lead to operational costs. (downstream, negative impact) | Transition risk | Market | Uncertainty of market signals | |

| Market | Increased raw material costs | |||

| Market | Increased logistics costs | |||

| Physical risk | Temperature-related | Heat wave | ||

| Physical risk | Wind-related | Storm/hurricane/typhoon | ||

| Storms (including snow, dust, sand) | ||||

| Water-related | Heavy rain (acute) | |||

| Sea level rise and flooding |

Policies Related to Climate Change Mitigation and Adaptation (E1-2)

Bittium’s sustainability actions are guided by the company’s Code of Conduct, sustainability strategy, ESG Policy and Environmental and Energy Efficiency Policy. In its environmental policy, Bittium has made a commitment to reducing negative environmental impacts. The policy lays down the key targets, which are to reduce GHG emissions, improve energy efficiency, ensure a sustainable supply chain and reduce waste. Bittium’s operations are also guided by the Environmental and Energy Efficiency Policy, which is aligned with the requirements of the environmental management system (ISO 14001) and the energy management standard (ISO 50001), specifies the commitment to energy efficiency, the metrics monitored by the company and the commitment of personnel and suppliers to environmental issues and energy efficiency, as well as compliance. Bittium’s policies cover all of its own operations, personnel and management in Finland, Germany and the United States. Bittium’s policies are also taken into account in the requirements related to value chain management, which means that they also cover all of the relevant geographical areas to that extent. Bittium’s Management Group is the most senior level in the organization in charge of the policies, and their implementation is monitored by the sustainability working group. Policies are reviewed annually, also taking into account stakeholder requirements. Such requirements can include new customer requirements and changes in legislation, for example. Policies related to climate change mitigation, climate change adaptation, energy efficiency and the adoption of renewable energy are listed on the following page in the table “Policies related to climate change mitigation, climate change adaptation, energy efficiency and the adoption of renewable energy”.

Actions and Resources in Relation to Climate Change Policies (E1-3)

In 2024, Bittium specified the time horizons defined in the 2024 materiality assessment and, with the help of an external party, defined its climate change-related physical and transition risks, carried out resilience and scenario analyses as part of the sustainability reporting and conducted its first more comprehensive emission calculations that include Scope 3 emissions. As a whole, the actions taken during the reporting year 2024 help establish a foundation for emission reduction actions in subsequent years. In the development of its sustainability strategy for 2025–2028, the company also developed its environmental targets to be more science-based and supportive of the targets of the transition plan.

Bittium’s action plans related to the management of GHG emissions and GHG removals, and transition risks, have also been defined in the sustainability strategy for 2025–2028. Bittium’s sustainability strategy establishes the strategic framework for Bittium’s sustainability efforts in the coming years, and the environmental policy defines principles related to the management of environmental risks and environmental efforts related to Bittium’s operations.

In 2025, Bittium plans to develop its emission calculation process, deploy an emission calculation tool and specify its transition plan for 2025–2030. Financial resources will be appropriately allocated to the deployment of the tool. Bittium also plans to take measures to improve Scope 3 information in 2025.

The targets of the transition plan prepared in 2024 have been set for 2030. Bittium will include the majority of its operational expenditure related to the transition plan, such as personnel expenses and software purchases, in its fixed operating expenses and processes, such as strategy work, product development and quality management. The most significant increases in operating expenditure are likely to be related to renewable energy, carbon-credited transport and the transition to greener transport, but these increases in operating expenditure were not realized during 2024. Bittium expanded the scope of its GHG calculations in 2024 to cover all of its sites and the company’s value chain. In previous years, the company has not had emission reduction targets for the entire company and its value chain.

Bittium’s policies and actions related to climate change mitigation, climate change adaptation, energy efficiency and the adoption of renewable energy are listed on the following page in the table “Policies related to climate change mitigation, climate change adaptation, energy efficiency and the adoption of renewable energy”.

Bittium has an ISO 14001 certified environmental management system. The ISO 14001 standard sets out the resources, processes and methods by which an organization can meet its environmental targets and improve its level of environmental protection. Bittium also has an ISO 50001 certified energy management system.

Policies Related to Climate Change Mitigation, Climate Change Adaptation, Energy Efficiency and the Adoption of Renewable Energy

| Impact, risk or opportunity | Policy | Actions | |

|---|---|---|---|

| Climate change mitigation | Growing regulation increases the need to allocate resources to monitoring, interpretation, the implementation of changes, and reporting. | Sustainability Policy, Environmental and Energy Efficiency Policy |

|

| Climate change adaptation | The growing demand for products and solutions that support the green transition and are energy efficient will contribute to the reduction of the in-use emissions of products and the reduction of customers’ emissions. | Sustainability Policy, Environmental and Energy Efficiency Policy |

|

| Energy efficiency and adoption of renewable energy | Transitioning the company’s own business premises to renewable energy and improving energy efficiency through ecological product design, which reduces the in-use emissions of products. | Sustainability Policy, Environmental and Energy Efficiency Policy |

|

Targets Related to Climate Change Mitigation and Adaptation (E1-4)

Bittium is committed to combating climate change by setting targets concerning energy-efficient products and lower-emission business operations in accordance with its sustainability policy and environmental and energy efficiency policy. The policies are described in more detail in section E1-2. The energy efficiency metric is defined as the development of energy consumption (MWh) in the value chain, and the metric used for the company’s own operations is the development of the share of renewable energy of total energy consumption (%). The implementation of the transition to lower-emission business operations is monitored in terms of the development of the organization’s emissions annually compared to the target level and by examining the change in absolute emissions in relation to net revenue (tCO2eq/M€). The company uses a transition plan to guide its operations towards lower emissions.

The base year for Bittium’s transition plan is 2023. The emissions calculation for the base year 2023 was carried out in accordance with the E1-6 disclosure requirements, and it includes Bittium’s material indirect Scope 3 emissions in the value chain. The emissions in the base year are listed in table E1-6.

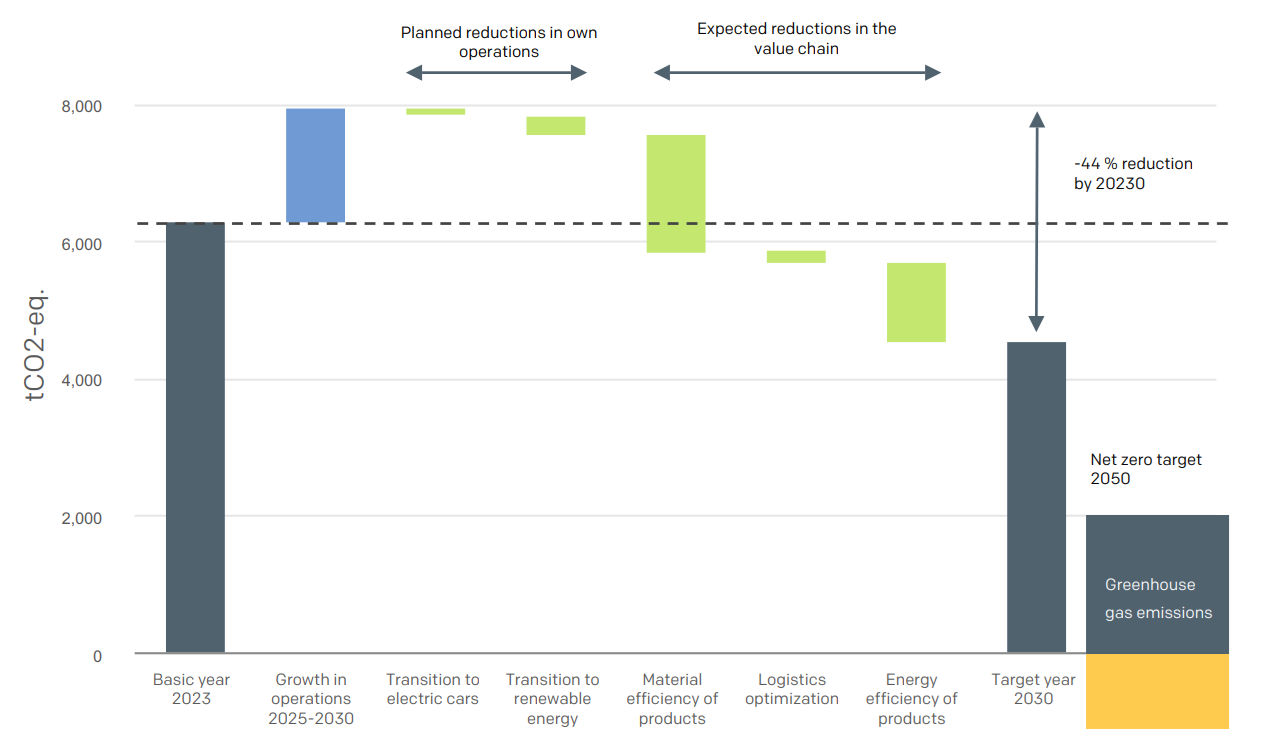

The guidelines provided in the “Pathways to Net-zero – SBTi Technical Summary” document (version 1.0, October 2021) have been utilized in the setting of emission reduction targets. The Science Based Targets initiative takes into account the requirements concerning the limiting of global warming to 1.5°C. No sector-specific decarbonization guidelines were available at the time of reporting. The calculated emissions for the base year 2023, including Scope 1–3 emissions, amounted to 6510.7 tCO2eq.

Bittium’s target is to achieve net zero in its own operations (Scope 1 and 2) by 2030. This target can be achieved by transitioning to district heating and electricity produced from 100% renewable and emission-free sources and by replacing leased vehicles under Bittium’s control with fully electric vehicles by 2030. When examining the emission reduction measures, it should be noted that Scope 1 emissions represent approximately 0.4% of Bittium’s total emissions, while Scope 2 emissions represent 4.8%. Market-based gross emissions have been used in setting the emission reduction targets. Bittium aims to reduce Scope 3 emissions by approximately 40% and total emissions by 44% by 2030. Scope 3 emission reductions will be allocated to the emission source categories identified as the most significant, namely purchased products and services, logistics and the energy and material efficiency of products. More detailed actions and time horizons will be specified in 2025.

Bittium engaged its personnel in the assessment of emission reduction measures by means of a survey. Emission reductions have been calculated as percentages relative to the 2030 targets. The company continuously monitors market developments, such as the adoption of new technologies and regulatory changes, to ensure that its emissions targets will be met and to remain competitive in climate action. No technologies related to the achievement of GHG emission reduction targets were adopted in 2024. Bittium’s emission reduction target has been set to be achieved by 2030 and no milestones were set during the reporting year.

Transition Plan for Climate Change Mitigation